How to Check BVN: Have you forgotten your BVN? Or, did you misplace the book, paper or phone in which you saved or stored the number? Do not be worried, it is quite easy to get your BVN using your phone.

Please carefully read through the guide below to learn how to check BVN and know your BVN using your phone. However, before delving into how to check BVN, what is BVN?

What is BVN?

Before we talk about how to check BVN, note. The Bank Verification Number commonly called BVN is a biometric identification system implemented by the Central Bank of Nigeria. The aim is to curb or reduce illegal banking transactions in Nigeria.

Also, it is a modern security measure in line with the Central Bank of Nigeria Act 1958. And it is to reduce fraud in the banking system. The system works by recording fingerprints and a facial photograph of the client.

The BVN or bank verification number is an 11-digit number. And it is exclusive to each person. But it is the same for that person across all banking institutions.

When is BVN Issued?

Once you open your very first account in a bank, a BVN is issued to you. This BVN will remain the same. And it will be used when next you need to open a bank account in Nigeria.

There have been some controversies about the security implication of having all bank accounts in different banks linked to one number, but the BVN has come to stay. You needed to know this before we talk about how to check BVN.

Why BVN is Important

The Central Bank of Nigeria adopted the Bank Verification Number, also known as the BVN, as a biometric identification system to stop or lessen unlawful banking activities in Nigeria.

Also, it is a contemporary security mechanism. And it complies with the Central Bank of Nigeria Act of 1958. It is important because it lowers banking system fraud.

Three Amazing Ways on How to Check BVN

There are numerous methods how to check BVN, but here, we will discuss how to check BVN online using the internet, using an authorized USSD code and the manual method.

-

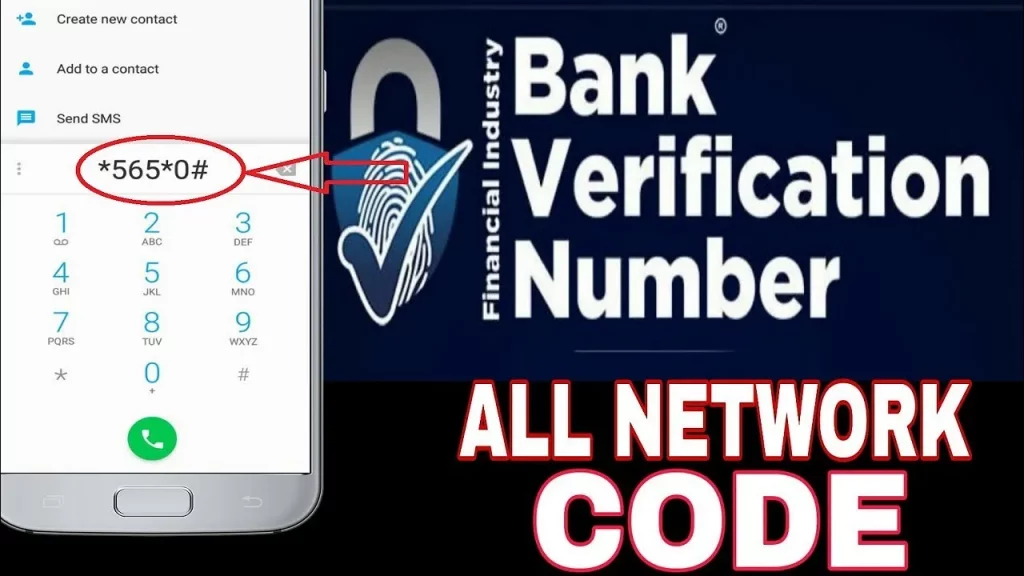

How to Check BVN Using an Authorized USSD Code

This is one of the ways on how to check BVN. Using a SIM card that is registered, you can check your BVN. You only need to dial *565*0# on the mobile device you used to register for the account. But there is a cost to pay.

READ ALSO!!!

You’ll be debited N20. If you haven’t signed up yet, you’ll be informed that “Sorry, your number is not registered on the BVN platform. I appreciate you using the BVN service. N20 has been paid by you for this service”. This method works for all banks.

-

How to Check Using the Internet

This is one way on how to check BVN. You accomplish this via your bank’s internet services. You undoubtedly entered your BVN when you opened a bank account. If not, you wouldn’t have seen the operation of your bank account.

As a result, you only need to access your Personal Internet Banking Services to find your BVN.

-

By the Manual Method

This is one way on how to check BVN This can be achieved by walking down to any of your bank branches near you and meeting the customer care unit. They will be glad to assist you in checking your BVN details.

FAQS on How to Check BVN

Below are ways on how to check BVN:

-

How does one Check BVN Online?

To check your BVN online, Visit the Internet portal of your bank. Check for where to see customer information and you will see it on the internet portal.

-

How do One Verify BVN on Flutterwave?

A Bank verification number (BVN) is only available for Nigerian customers. This is a means of verifying a customer and can be used for KYC. Customer supplies their BVN and you call our Resolve BVN details endpoint. This service costs N50 per call.

-

How do I Get My BVN?

To get your BVN, visit your Bank branch and complete the enrolment form if you have not. Your biometric data (fingerprint, photograph and signature) will be captured on the system. And you will then receive a Ticket ID. BVN will be sent to your registered mobile number.

-

Is BVN the Same as Account Number?

The BVN or Bank verification number is an 11-digit number. It is unique to each individual, but the same across all bank institutions for the same individual. It is not the same as the bank account number.

To own and operate a banking account in Nigeria, you must first have a bank verification number. Once you open your first bank account, a BVN is issued to you.

-

What is BVN Number Used for?

The goal of the Bank Verification Number (BVN) is to uniquely verify the identity of each Bank’s customer for ‘know your customer (KYC) purposes.

-

Is BVN compulsory?

Yes, it is.

-

Can a Person Have Two BVN?

It’s one BVN per person. You are not meant to have more than one BVN. If you do, you’re going to end up on EFCC.

-

Can I Change My Name on My BVN?

You can make changes to almost everything on your BVN like your name, date of birth, email, phone number, and so on. But you cannot change your picture though. However, you must have a valid reason for the change.

-

Who Started BVN in Nigeria?

The Central Bank of Nigeria, in collaboration with the Bankers Committee in February 2014 started it.

What happens if BVN is blacklisted?

You will be unable to secure a loan. The most immediate consequence of being on the BVN blacklist is that defaulters will be unable to secure further credits.

BVN is a significant and advantageous development for the banking sector. Due to its capability to give each consumer a distinct identification, fraud has decreased.

Also, the loaning process has been made simpler. Hopefully, you are now well-versed on the various methods available and how to check BVN without getting to ask anyone for help.